Crypto for Designers

NFTs and Cryptocurrency Tips for Creators

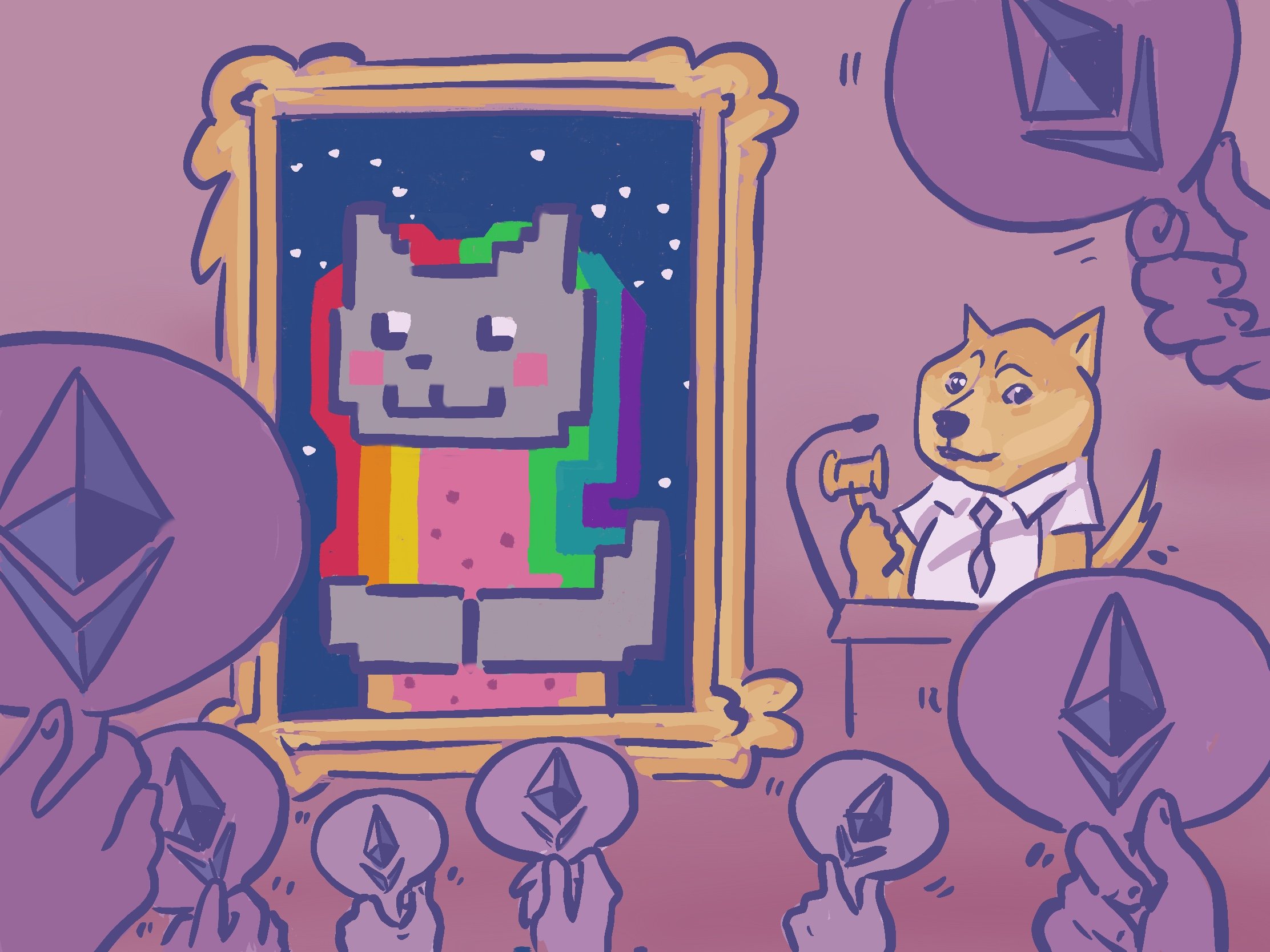

My friend texted me excitedly as a piece of internet history sold for just under $600,000 in Ethereum on a gen-Z style Sotherby’s website. We rabidly watched this auction unfold. But this was no Banksy. This was a gif of a 8-bit pop-tart bodied cat farting a rainbow. This was Nyan Cat, a well loved ancient meme turned non-fungible token, blazing back into relevance like Fleetwood Mac on an Ocean Spray splattered skateboard.

There’s a lot to digest in that first paragraph. Let me help you.

This article is written by a curious design-minded person with a creative background. I am qualified to talk about this because I made up my job many years ago. I live for this exact moment where the vast potential horizon of art meets its practical implications. This is a no-fuss, down to earth explainer of cryptocurrency, NFTs, and the many implications of this new art form. In short, I believe we’re watching history unfold, and full disclosure, I’m still learning. But so is everyone else. Let’s learn together.

This is not financial advice. Again, I am not a financial advisor, a CPA, or an ~“*accountant*”~.

If crypto isn’t a new concept, skip down to Call Me by Your Sign.

If you’re here strictly for NFTs, skip down to Reigning [Nyan] Cats and Doges.

If you’re curious about ethical impact, skip down to The Fine Print.

Crypto/Economic Crash Course

I first heard about cryptocurrency in 2010. I had to check that date several times to ensure this was accurate. I leaned against the family computer, eyebrow quizzically raised, as my family member explained Bitcoin to me. Bitcoin was a string of code that allowed you to transfer money between individuals but also functioned like a stock, at least that’s what the dubious 4Chan message board said. Unlike traditional EFTs, we didn't need a trader or a $5K minimum to purchase. Further, it wasn’t meant to be a currency as much as a new way to internet. My relative’s weird Internet friends swore this was the future. We discussed splitting one coin, which was around $240. This was an unfathomable sum at the time, especially while saddled with school debt and holding down two jobs post- housing crisis. We debated the benefits of mining our own blocks with one small problem: neither of us knew how to code. In hindsight, it wasn’t the right time.

Before we can even broach NFTs, I’m going to outline why cryptocurrency in general matters. It is the foundation of what we’re trying to play with, and we need to grasp “why” it exists even if the “how” escapes us. We can participate at any level of awareness, but a deep one will serve us better in the long run.

Cryptocurrency is an economic market built on code, specifically blockchain. Hackernoon explains blockchain in layman's terms here, but a simplistic comparison is the internet but for cash. Computers connect to a shared network without a physical location and can use secure connections to pass each other money. No one person holds the keys, and every machine verifies the shared history, which makes records impervious to tampering. When a code is written, it is verified by multiple computers in the system and locked in a “block”. The next block is formed in connection to the prior one, which over time creates the “chain”. Because multiple machines have registered this code, it’s much harder to corrupt.

Still over your head? If you’ve ever thrown shade at a group chat, you can grasp blockchain. Picture an extended family group text. If your racist, technologically inept uncle says something inappropriate and you call him out, he may try to delete his comment on his end of the chat, lol. But it will live on in infamy for the rest of the family. And if you spin off to shit talk in a side text with your cousins, you’ll probably start with a contextual screenshot or comment linking back to the original comment. Your parents are doing the same thing in their side discussion. And so it goes. Again, we don’t have to completely understand blockchain to throw $20 into a crypto wallet. Things are both much simpler and more complicated than that.

In short, cryptocurrency is next-gen social media with a focus on buying rather than socializing. Economies materialize via trade and bartering, which social media has encouraged us to do for almost a decade. We evolved trade into attention economies and virality, but these are volatile markets and don’t always translate to actual dollars. Social media platforms leaned into personal relationships to massage money from our pockets by way of targeted ads, sponsored posts, and marketplaces. These companies are centralized platforms, meaning those like Facebook have a headquarters, hold our accounts on its servers, etc. This also means they ultimately control data, ad dollars, and censorship. The political distress from last June to January underscores how wildly dangerous this proves to be; Facebook is operating outside of government jurisdiction. This setup is known as Web 2.0, meaning tech power is held by corporate entities that everyone plugs into to use. However, cryptocurrency and DeFi (decentralized finance) signal the emergence of a new horizon, Web 3.0. It sounds nebulous and philosophical, but social media is web 2.0 and Web 3.0 is a social media style economy. We are watching a borderless country emerge, one where people are connected by cryptocurrency rather than geography.

Bitcoin Vs Ethereum

You may be wondering: why is everyone suddenly talking about Ethereum, not Bitcoin?

Very simply, Ethereum is an expanded version of Bitcoin, the proverbial iPhone to the Blackberry. Bitcoin is the oldest DeFi currency, but it’s clunky and slow; it takes ten minutes to write and verify a block of Bitcoin code, whereas Ethereum takes fifteen seconds. Whereas Bitcoin was built to funnel capital but not to evolve, Ethereum is used to build businesses and code as well as move money and assets.

“ ‘Ethereum was designed to be much more than a payment system. It is a quote to centralized platform that runs smart contracts: applications that run exactly is programmed without any possibility of downtime, censorship, fraud or third-party interference.’If your house protocol is built to allow flexibility and increased functionality to provide the ability to program many different types of smart contracts within the Ethereum system.” — via the Economist

While Ethereum stands to become the next major player in a DeFi version of the internet, hedgefunds and big banks began buying into Bitcoin in December. This means the OG is likely not going anywhere anytime soon. While it might be a great place to start investing, it’s not a viable long term solution. Bitcoin code can evolve, but the consensus process for change is comparatively slow. Bitcoin is powered by a concept called “proof of work,” meaning the code is generated by solving complex math problems. There is no way to shortcut harvesting, and the consequences are dire. The amount of energy used to build Bitcoin is greater than Amazon, Facebook, Apple, Google, and Microsoft combined, according to this short write-up by the Eco Experts. This is more energy than is powering any single country. However, Ethereum and the other coins built on its platform have a much quicker engagement; some coins promise a democratic partnership with users. Ethereum is built on a slightly different system, proof of stake. Those that hold quantities of ETH can create the rules. This means protocols can be voted out over time, rewritten, and flexed for unforeseen circumstances, one of which being climate implications. But more on that later.

Again, there are many types of coins. Do you research to determine how much risk you’re willing to take. The riskiest factor is the biggest benefit: crypto is untethered to traditional institutions. No one will ensure your coins if the market suddenly bottoms out. Anyone holding crypto suddenly has much more in common with their great-grandparent stuffing cash into their mattress. This mattress can work for you, but as with most things, proceed cautiously.

So now that we’ve covered all the dry stuff, what does this have to do with art?

Call Me by Your Sign

Financial bros will swear up and down about numbers, dips, and holds, but cryptocurrency is first and foremost psychology. As creative people, we are aware of human patterns more than the average human. It’s our job to anticipate behavior and make unforeseen connections. There are cultural explanations for rises and dips if we know where to look. Every coin writes its own rules; some self-regulate and some desire for community input as a reason to buy.

People love to form like-minded communities. This can look like hashtags and fan accounts, but communities are also made up of purchases. Target was busted for anticipating pregnant women through their search histories and targeting them with baby ads, in some cases prior to the subject’s knowledge of pregnancy. Data like this translates into a world of abstract ideas like cryptocurrency. How do people choose where to congregate? Even if you don’t understand the underlying code, the simple answer is call signs. In a foreign landscape, people look for markers of home, things they understand. It’s very easy to throw money into a currency that doesn’t mean what you think it means.

For example, I saw Black investors buzzing on Twitter about AAVE in October. I was curious and originally mistook this as discussion of African-American Vernacular English. My first thought was to invest in this crypto to support of Black investors. Only after I invested did I research AAVE a Swiss lending currency, which is Finnish for “ghost”. The connection to the African-American community is therefore pure coincidence. Yet, when February 1 rolled around, I noticed a spike and sustained hold in AAVE. Many others seemed to make the same mistake I did in honor of Black History Month.

The month-long trajectory of AAVE via Coinbase.

A more obvious example is the now infamous Doge. Dogecoin is a literal joke named after a Shibu Inu meme from the late 2000s, serving no purpose outside of a commentary on the great Dadaism of the internet. Cryptocurrencies are built on computer networks that verify activity like code, cash, and transfers; Doge doesn’t offer any of that. It is a code running free with the occasional zoomies. Of all the coins it’s the most unstable because it serves no purpose. But the Internet loves to give value to nonsensical things. Known as a pump-and-dump coin, it experiences rare and intense spikes before plummeting to the ground which makes it attractive to day traders. Yet Doge has managed the unlikely; enough Internetters rallied around the coin that it could actually stabilize. Thank Elon Musk or the chaotic hoards of WSB Reddit. Regardless it’s moving through a pullback but has yet to nosedive. Meme culture jumped on this crypto eagerly, creating more and more memes that boosted the unlikely coin’s reputation. Somewhere a comment spammer is typing “To ThE mOoN!” with glee.

Doge is an extreme example of financial communities, but the same rules apply in some form. While it may yet be a joke, it can teach us about internet humans, namely buyers. Don’t be tempted to write off Doge’s lessons altogether, as this segues perfectly into what NFTs could possibly do for you.

Reigning (Nyan)Cats and Doges

NFT is short for Non-Fungible Token, which is very quickly explained by Anabela Rea at Sylo Wallet. A token is an object, whether a piece of art, a video, a sound— anything ownable. The non-fungible part sounds strange, but it’s the difference between buying a book off a shelf and having the author personally sign your copy with a thoughtful note. The value is the human touch on a non-physical, digital asset. The value is more than an autograph; similar to prints, an artist can mint a unique asset or a limited set of digital prints. In an infinite place like the internet, the impetus to purchase comes from the authorship component that is both traceable and verifiable. The authorship is written in the code. NFTs are uploaded or minted into an Ethereum marketplace where others can buy or trade for your digital asset. Each platform runs differently, so check the fine print. Some prefer Buying with ETH goes a step further; the buyer isn’t committing to a fixed price; ETH’s value fluctuates wildly and especially when high price items are being auctioned.

In some ways, this solves a lot of problems, but it also creates new ones. Legislation cannot keep up with internet makers, nor is this a priority because it hasn’t been proven to be wildly profitable. Citation and ownership has been a huge issue in IRL and Web 2.0 spaces anyway. Will this help or augment those struggles? Artists are also scratching their heads because the audience is unclear. The anonymity surrounding transactions raises many questions: is this an eccentric internetter or an art buyer? And what will they do with my NFT? Below are my assessments about why, what, and who will benefit:

NFTease Me

The barrier to participation is high; you need a fundamental understanding of ETH, a crypto trading wallet, and a private wallet where you control your key. Bidders also need to grasp the fluctuation of crypto, the concept of gas, and how high-risk bidding impacts the rest of the Ethereum system. This means key players with ETH to burn are likely independently wealthy. It’s safe to say there’s a generous mix of tech people, eccentric internetters, and wealthy trolls. For most of us, these are not our typical audiences.

Make no mistake, the ultra rich are playing in this arena too. The anonymity would be attractive to high profile collectors. Auction house Christie’s has scheduled its first NFT auction featuring a retrospective of digital artist, Mike Winklemann, known as Beeple. Is this in response to the overwhelming success of Nyan Cat? Regardless, these avenues open high and lowbrow opportunities for artists of all types.

The collector audiences seem to vary wildly. Foundation.app is the site of the Nyan Cat auction, which seems to attract a more polished aesthetic as well as its invite-only competitors like Nifty Gateway, Zora, and Super Rare. NBA Top Shot is keeping sports alive in the way of collectible sports moments from important games. Their tokens are niche and look like game footage from the stadium clipped and condensed into 3-pointers and countdown clocks, basically a lo-if looping highlight reel.

Who will benefit?

Motion and 3D artists with Futurism Aesthetic.

When a new vehicle for art emerges, Futurism is usually the first face. Look back to the 60s space race and the candy-coated Apple futurism of the early 2000s. But every major tech movement starts this way; this art style literally points to progress. It requires huge graphic chips and complex files. VR and AR also currently favor abstract futurism. Looping videos perform best, possibly since NFTs can live in Living Art frames and monitors thanks to their universal .MP4 formats. There are also early examples of artists minting sounds/music. If this doesn’t describe your aesthetic, don’t worry! Futurism is meant to augment the obvious disruption of reality and point towards possibility, but long-lived tech tapers over time to favor humanistic, subtle integrations. NFTs will see their own version of a craft movement, though this will present itself as a decidedly different wave.

There are few examples of static imagery doing incredible numbers, but perhaps that’s because we haven’t broached the potential of what static images can carry. Platforms like Rarible encourage creators to include a tangible object for purchase to smooth the value connection for buyers. Selling images for $1.5-6k ETH is nothing to sniff at. Photography and 3D have a huge role to play here, especially when their subjects bend reality.

Originators of Memes.

If the internet disrupted your privacy/sanity as a direct result of meme culture, you may finally be entitled to compensation! Nyan Cat’s overwhelming success seems out of reach for the average creator, but a quick scan of other sold NFTs on Foundation yields some familiar faces. @Dom, one of the creators of Vine, minted and sold one of the first Vines for a cool $18K in ETH. In some ways, this is a chance to look back in gratitude to those who shaped the Internet in some mundane yet profound way. Until this moment, there was no way to handle authorship of memes, but thanks to those documenting meme culture, a verified creator stands to do well with nostalgic internet-savvy buyers.

Off-beat Creators.

Don’t fit in a conventional box? This might be a great market for you. The cottage industries built by design, illustration, and photography for example rely on a DTC (direct to consumer) model, at least that’s how noteworthy personalities in those industries have built their presence. Paper goods, posters, digital downloads, and stickers are easy for the average person to purchase, but this also puts creators at a disadvantage: who will buy a 1.5 ETH digital asset if they can get a print for $60? Gif creators, animators, videographers and others living between digital and analog worlds might find a home among NFTs. Undoubtedly they will be concept focused rather than process motivated in part because of the inherent distance between buyer and seller. Those open and willing to collaborate may see huge success by combining forces with others for motion or sound. There are many possibilities for those of us willing to experiment.

Collectible creators.

And I don’t mean baseball cards. If you can think in a series, this will be interesting to you. Only a handful of sites allow multiple “prints” with a definitive cap, but there’s room to experiment. What does it look like to document history? To share a thought or audio note? If you are embedding info into the blockchain, you are embedding your work into digital history. Does that change what you upload? Is this more than a race to share prints?

Some quick tips to get you started on your NFT journey:

Research a trading wallet and a private wallet.

A trading wallet would be somewhere like Coinbase, Kraken, or Binance. This wallet gives you access to a platform where you can buy and sell ETH and other coins. However these companies are centralized, meaning they hold your crypto on their servers, which leaves you open to a potential hack. Private wallets like MetaMask ask you to create a password and provide you a private key, a string of random characters that you need to verify the wallet. It is recommended to store the keys on paper and in multiple places. If either key is lost, it is impossible to open the wallet.

Test the waters.

I recommend throwing $5-50 into a trading wallet and moving it around for a week or two. If you’ve never owned crypto or EFTs, it’s important to understand how it moves. If you see any drops or crests, do a quick google or surf Twitter for potential causes. When you begin to read the rise and fall of culture, it becomes easier to ride the digital waves. Again, wallets are uninsured and therefore can have transactional issues. I lost $100 out of nowhere during my third seed transfer. I contacted customer support, but it was a cumbersome process. I have yet to hear back. C’est la vie.

Keep an eye on gas.

Gas fluctuates wildly based on usage, like in real life. Again, this a virtual supply and demand setup, which means patience will help you make the most of your cash. This website helps chart slow vs. busy times and is worth consulting while you mint. Spikes occur often when the market is active and also during high profile auctions, so double check your overlap.

Determine usage.

I’m hesitant to give up work without sustained rights usage, but I also recognize NFTs might be ephemeral. It’s preferable to retain some rights to your work, especially if people buy or sell your pieces. If you’re unsure, do a test run with a different style or concept. Learning anything new requires risk, so calculate what you’re willing to try.

The Fine Print

There are so many possibilities with new technology, and naturally fine print emerges. We hear the phrase “move fast and break things,” but sometimes “things” is a euphemism for people, ethics, or the environment. We should absolutely weigh the setbacks of participating in a new system while understanding our hesitations directly reflect broken systems IRL and in Web 2.0. Here are three major considerations we will find ourselves simultaneously unraveling in IRL/Web 2.0 and knitting into Web 3.0 practices:

Taxes and other financial stipulations.

Artists are understandably nervous about NFTs. Again, there’s a lot of privilege wrapped around new technology. Not only do participants need a working knowledge of cryptocurrency (any lessons learned involve losing cash along the way), but they have to be willing to hold their earnings for over a year or face a hefty 30% tax for cashing out. According to current US law around cryptos, converting currency within your wallets are non-taxable transfers. This is consistent with traditional EFTs, again more privileged knowledge. Upload percentages and gas fees may be subject to sales tax, but that will vary by auction site and state of residence. Some platforms charge a fee to upload, mint, and change the price of an NFT. Some cover the upload price, which varies based on user activity and the price of ETH, known as gas. Others like Maker’s Place allow you to mint a limited series or hold a license percentage; theoretically you’d receive a royalty every time the asset was bought and sold.

This substantially limits who can participate. I paid out $100 bucks to upload my first NFT; unbeknownst to me the Nyan Cat auction was in full swing. That was an unfortunate mess. I was given the opportunity to choose my gas price based on speed (slow, med, fast), which is reminiscent of unleaded, leaded, and diesel fuel pumps. Anything above free is still a prohibitive number to many artists, especially now. Given the newness of these assets, it’s unclear what an individual creator is responsible for during tax time. Ethereum will likely undergo some market regulation in 2021, but in the meanwhile we’ll float in ~”*the ether*”~. Prepare yourself as best you can; holding your winnings is both the privileged and safest position.

Authorship and Citation.

Embedding artwork in the blockchain provides artists with internet-wide verification. This is a huge step forward for authorship of any kind, especially due to the millennia-long problem of artistic theft. I have written (and will write) extensively on the subject because imitation is not an innocent problem. Over time and at scale, poor copying erases marginalized people groups. While a new digital frontier is an opportunity to start fresh, we have to be hard and fast about what is and is not appropriate. Obviously a meme from the originator will have the most value, but what if someone mints a copy for fast cash?

We have to grapple with the obvious: ideas are not free. They cost someone, somewhere something. As we transition to a decentralized internet, we need to examine why imitation, copying, and artistic theft have been tolerated so long and why it’s worth leaving this practice in the past. Authentication can be a huge step forward. We will be asked to grapple with so many ideas such as uploading works from dead artists, how far IP extends between a creator and a “sample”, how to parse contracts between multiple collaborators if only one party can be paid out via wallet. We can build on these ideas if we hammer out better citation protocols now while things are less complicated.

I would love to see AI and machine learning harnessed to verify NFT makers. Since our internet identities are interconnected, it would be possible to track and verify art styles, evolutions, and deviations to create a more realistic picture of an artist’s identity. Web 2.0 algorithms have failed us. We were boxed into an aesthetic, unable to grow or evolve. Ethereum could scan an artist’s history and verify their trajectory organically. This means AI designers and ETH programmers have to be run from an ethical place. ETH authentication could provide reparations for Black, Indigenous artists, Latine and Asian creators, the queer community, women, anyone who history has forgotten or white-washed. It is possible, we merely have to speak the possibility into existence!

Environmental impact.

This is a glaring issue, especially as Texas freezes over and most of the US interior reaches record lows. Perhaps the most obvious reason to pause in the race to cash in on NFTs is sheer power required to connect and verify the blockchain across devices. This tweet thread and the following comments express real concern about the wasteful energy to upload NFTs.

Cryptoart.wtf gives a breakdown of waste and equivalent power usages. The numbers are staggering. Why energy usage so taxing? Simply, it was designed this way. The mining requires multiple verifications within the span of several seconds. During my NFT upload, I was verified by 58 devices. These devices are both creating and verifying blockchain during my upload. That takes a lot of power.

And yet, it’s important to acknowledge the privilege of leading a climate change discussion. If we can pause to consider the long term impact of crypto energy usage, it probably means our immediate needs are met. We likely have money to burn, and we are probably further removed from those that will suffer greatest in the long run. This year has been difficult on everyone. We need to check our own efforts before asking others to pause.

The sad reality is that the creative industries have always been extremely wasteful. If you straddle tech, design, fashion, or exhibit industries, your livelihood is directly tied to the leading pollutants and most exploitative industries in the world. Design and tech burn through power, and currently rely on child labor to mine cobalt for batteries. Yes, we are still using child slave labor. Paper waste is built into our profit margins. We still use plastic in our packaging projects. We hear about the costs of new denim, but we rarely see a breakdown. The water used to grow cotton and dye fabric is amongst the most wasteful. That doesn’t begin to count shipping costs; clothing is often manufactured in China or India and sent to traditional fashion hubs like France or Italy where the label is attached to boost the perceived value. Once it leaves the store, it may be shipped to you, wherever you are. Have you ever been to an Adobe conference? The budget for decor and screen usage is staggering. Have you ever been on a cruise? You’ve done the same amount of damage as an NFT. Niche conventions are economies for entire cities; do the math on their bills.

It is valuable to raise climate questions while taking responsibility for current creative practices. I admit I’ve benefited from flashy conferences, hungry set lights and cameras, flying for my job. Within my own practice, I limit food waste, buy vintage and reuse set pieces or gift them to others. I live in a modest apartment and have gone long stretches of my adult life without a car. And I can continue to do better. There’s no ceiling for doing good, no point of arrival. Trying to limit others only underscores the privilege we hold. A good rule of thumb is to take a “yes, and” approach. If we plan to participate in a blockchain economy, we need to get loud about climate costs. To own ETH is “proof of stake,” which helps us contribute to rules and protocols. We can demand that energy becomes more efficient. So yes, participate and actively work towards change. If you feel inclined to put more energy towards lessening emissions IRL, please do so. Blockchain and digital discussion surrounding it is valuable because it is verifiable. Your position on these subjects matter now, as much as they will months or years from now.

There is so much possibility at the edge of our horizon, and like all new tech requires some bug fixes. In general we can expect exciting possibilities from crypto and NFTs. Together we can help write the rules of engagement to profit off these opportunities.

This article was a labor of love for the creative industry. If you feel so inclined, I would appreciate your subscription to Design & Us or a tip at @mbleue on Venmo.